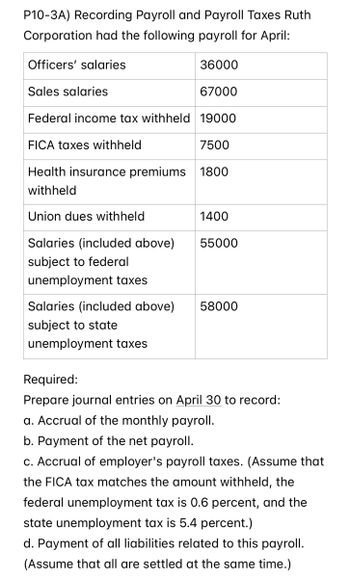

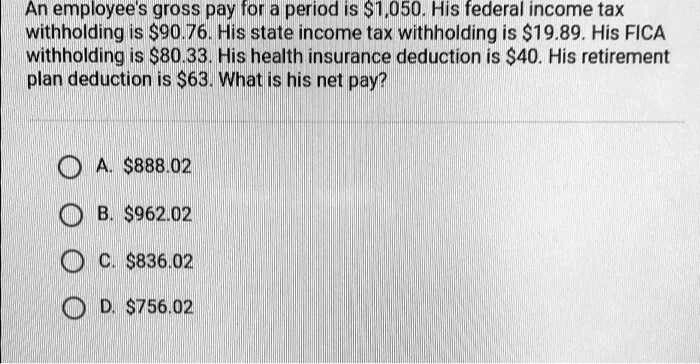

SOLVED: An employee's gross pay for a period is 1,050. His federal income tax withholding is90.76. His state income tax withholding is 19.89. His FICA withholding is80.33. His health insurance deduction is

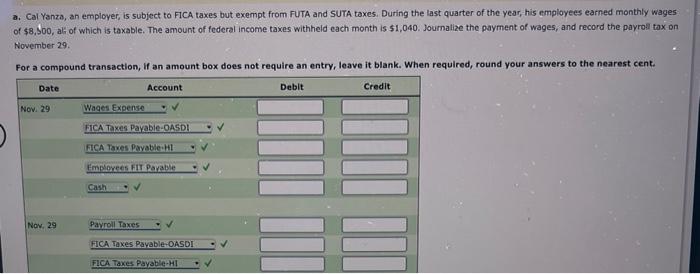

Solved: BMX Company has one employee. FICA Social Security taxes are 6.2% of the first $137,700 pa [algebra]

:max_bytes(150000):strip_icc()/fica.asp_FINAL-428c1827d08648be803aea413ebacd15.png)

.jpeg)

:max_bytes(150000):strip_icc()/fica-taxes-social-security-and-medicare-taxes-398257_FINAL-5bbd10af46e0fb00266df9ec-b3794e561e094118ad5b5ed3c6898880.png)